WEBINARS

WEBINAR SERIES

NIBAF in collaboration with AAOIFI arranged a webinar on Demystifying Ethics for Islamic finance professionals. The webinar was conducted by Mr. Farhan Noor, Head of Capacity Building Programs, AAOIFI. He shared his insight on the conceptual framework of code of ethics for Islamic finance professional. He highlighted that given the significance of ethics for the future of Islamic finance, AAOIFI Governance and Ethics Board initiated the comprehensive Ethics Project in March 2016 to develop 4 documents:

• Code of Ethics for Islamic Finance Professionals

• Handbook

• Governance Standards on Ethics

• Code of Conduct for IFIs

The speaker highlighted that the code of ethics for Islamic finance professionals was applicable to the professionals and not to the institutions. The code was finalized after conducting 59 interviews in 4 countries. The code was issued in December 2019 and effective form January 1, 2020.

He highlighted that the code was divided into three parts i.e. conceptual framework, illustrative violations and illustrative ideals. The speaker involved the participants through an interactive session and responded to queries of the participants.

For Full Video Recording Click Here

The webinar was conducted by Mr. Imran Ahmad, Additional Director, Development Finance Support Division, SBP Banking Services Corporation and and Muhammad Jehanzeb Saeed, Head of Home & CDF Products Consumer Banking; Dubai Islamic Bank Pakistan Limited.

Mr. Imran Ahmad highlighted presented a historical perspective of housing finance in the country and highlighted the measures taken by Government of Pakistan and state bank of Pakistan for introduction of affordable housing schemes

Mr. Jehanze Saeed underlined the need for further promotion of the housing finance given the fact that in comparison with the other countries in the region, Pakistan’s share in housing finance is low. He highlighted the efforts of SBP and Government of Pakistan for promotion of the housing industry. He also elaborated Islamic modes for housing finance.

For Full Video Recording Click Here

NIBAF in collaboration with Bahrain Institute of Banking and Finance (BIBF) arranged a webinar on Decentralized Finance, NFTs’ and the Metaverse: Islamic Finance Use Cases. Mr. Mujtaba Khalid, Head of the Centre for Islamic Finance, BIBF conducted the webinar. During the session, the speaker shared his insight with the participant on the subject and underlined the need for use of technology in the Islamic banking industry. He also responded to queries of the participants.

For Full Video Recording Click Here

The webinar deliberated on SME banking specifically to explore successful business models to help establish it as a viable business proposition in Pakistan. Panel speakers included two renowned international experts on the subject area i.e. Mr. Klitos Georgiou and Mr. Kaiser Naseem, who provided global perspective and key constraints to SME banking. They also deliberate on interactive approach to SME banking and successful business models. Mr. Klitos specifically discussed product optimization and market strategies, while Mr. Kaiser discussed important and emerging aspect of SME banking that include IT, MIS, delivery and channel management. At the end, Mr. Aamish Ahmed provided prospects of SME banking in Pakistan. Around 220 officials from commercial banks, Micro-finance banks, SBP and BSC attended this webinar.

For Full Video Recording Click Here

The webinar provided valuable insight on the concept, products and business models of value chain financing. The webinar deliberated on VCF assessment and its related risk profiling along with leveraging technological innovation and advancement. Specifically, technology driven low risk product extends liquidity to important value chain agents that help financial institutions to provide loan to potential value chain borrowers with mitigated risk and better client’s assessment. Moreover, credit and payment risk decreased with shifting the focus from bi-party (FI-SME) relationship to a tri-party (FI-anchor-SME/Agri) relationship, hence leveraging the trade and payment between larger anchor and Agri/SME supplier/distributor. More than 300 participants representing commercial banks, Micro-finance banks & Institutions, SBP and SBPBSC attended the webinar.

Mr. Prasun Kumar Das - Secretary General APRACA was the lead speaker deliberated on VCF and its business models, while Mr. Yahya Hameed - Head Agri at Bank AlFalah and Mr. Yasir Butt - Head Product (SME) at Bank of Punjab discussed the scope of VCF in the context of Pakistan. Participants actively participated in the discussions and appreciated NIBAF for imparting knowledge on such important and emerging aspect of banking business.

The webinar provided valuable insight on the current financial landscape and the disruptive role of Fintechs in Pakistan. The speakers highlighted the regulator role in providing enabling Infrastructure to Digital Payment Systems and Fintech growth in the country; and the market positive response to these regulatory measures overtime, resulting in consistent growth in the number of Fintechs and their ever-increasing collaboration with financial services providers. This collaboration has led to ever-improving customer experience besides bringing greater efficiency in the provision of financial services. The speakers of the webinar are Mr. Shoukat Bizinjo Additional Director-Digital Transformation & Technology Governance, SBP, Mr. Omar Moeen Malik Head of Easy-paisa, Telenor Microfinance Bank and Mr. Qasif Shahid CEO & Co-Founder of Finja Pakistan. They discussed scope and innovative techniques for improvement of financial services in the country. The participants actively participated in the discussions and appreciated NIBAF for providing learning opportunity on such important innovative and emerging area. Around 400 participants representing financial industry, SBP, Fintechs, MFIs, attended this webinar.

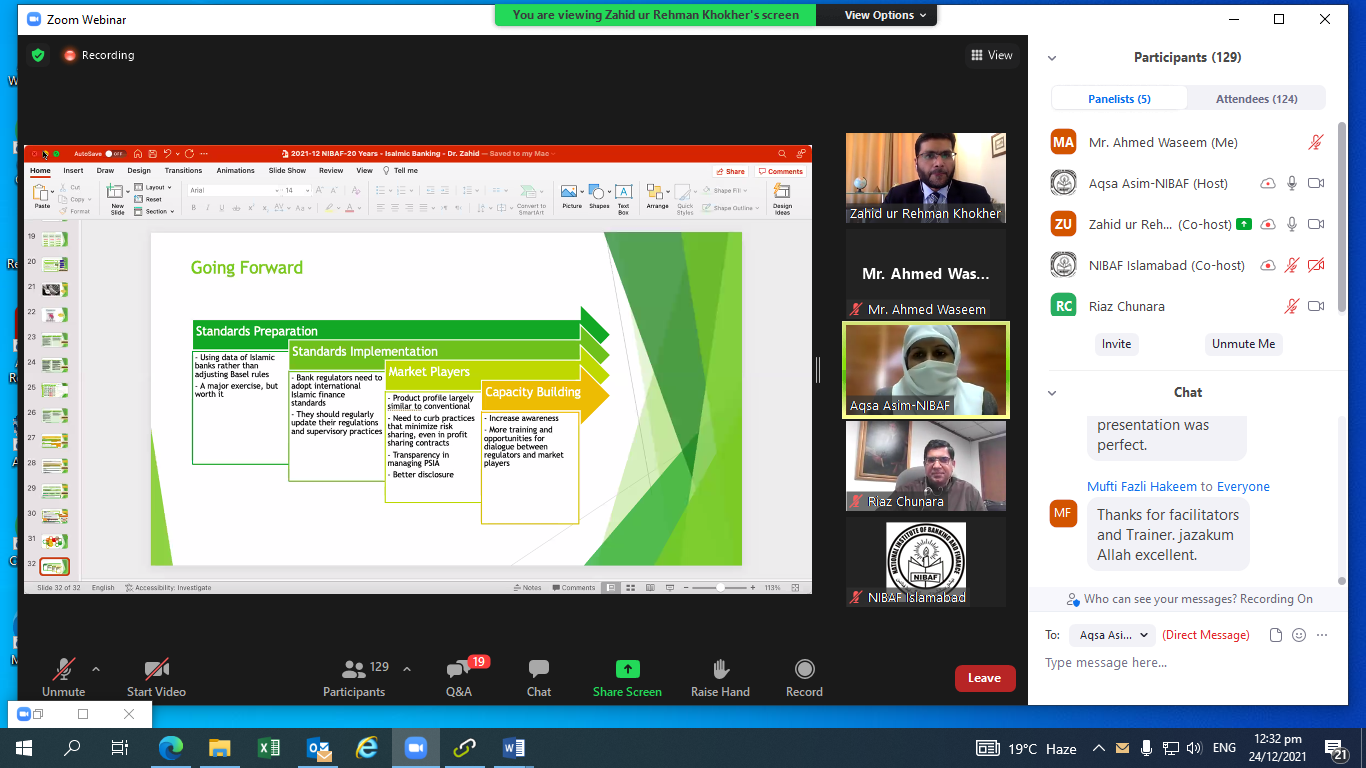

NIBAF arranged a webinar on Application of Basel Standards on Islamic Banking - What the last 20-years’ experiment tells us? The webinar held on December 24, 2021 was conducted by Dr. Zahid ur Rehman Khokhar, Ex. Assistant Secretary General, IFSB. It was attended by 167 participants. During the webinar, the participants were apprised about the subject. Moreover, towards the end of the webinar, Q&A session was conducted in which participants asked different questions which were adequately responded by the panelists.

NIBAF in collaboration with AAOIFI arranged a webinar on “Methodology to Adopt AAOIFI Standards & Addressing Gaps” which was delivered by Mr. Omar Mustafa Ansari, Secretary General AAOIFI and Mufti Irshad Ahmad Aijaz, Chairman, Shariah Advisory Committee SBP and SECP.

The webinar was held on December 23, 2021 which was attended by 206 participants.

NIBAF arrange a webinar on SBP Asaan Finance Scheme (SAAF) for senior officials of the commercial and micro-finance banks. Mr. Mazhar Shahzad discussed salient feature of the scheme and provide clarity on different aspects. The participants raise questions pertaining to its implementation process and tenor of the scheme, which was explained by the speaker. More than 100 senior officials of the commercial banks attended this webinar.

NIBAF in collaboration with Bahrain Institute of Banking & Finance (BIBF) conducted a webinar on “Block Chain- A Shariah Perspective”. The webinar held on October 21, 2021 was attended by 123 participants. Dr Ahmad Asad Mahmood Ibrahim from the BIBF delivered the webinar. The participants were apprised about basic concept, blockchain fundamentals, working and benefits, adaption of blockchain in Islamic commercial jurisprudence and its permissibility. The participants took keen interest in the webinar.

NIBAF successfully conducted yet another joint webinar with LIBF of the webinar series on Wednesday, July 28,2021. This time topic of the webinar was “Fintech and Financial Industry: Latest Developments and Their Impact”. A large number of audience from the Financial Industry as well as central bank and its subsidiaries attended this online session. Speaker, Ms. Helene Panzarino, CEO of New Financial Laboratory, briefed the audience on the challenges from FINTECH to financial industry. She also talked about the Fintech challenges in context of Pakistan. At the end of her talk, she responded to questions asked by the audience. Managing Director, NIBAF, Mr. Riaz Nazarali Chunara thanked the speaker for her valuable insights on the most relevant and critical topic and also highlighted the Pakistan’s central bank approach to the issue. He also appreciated cooperation with LIBF and hoped for greater collaboration in the times to come. MD, NIBAF also thanked the large audience for their interest in the webinar and for asking very pertinent questions. He assured of more such events in the future.

NIBAF and LIBF hosted a Joint online Webinar on Risk Appetite Framework: Capturing Financial & Non-Financial Risks, on Monday July 12. Mr. Olivier Beroud, Founder of the Centre for Governance, Risk and Regulation at LIBF was Speaker of the event and a large number of audience from the central bank of Pakistan, and other relevant organizations attended the webinar. Mr. Beroud spoke on the topic for about 20 minutes elaborating the concept and how to develop a risk appetite framework that runs consistently from strategic to operational level helping financial institutions better understand and manage their risks that are more aligned with their corporate strategy. He also talked about the challenges in the development and implementation of risk appetite framework.

After his talk, he responded to the questions tossed by the attendees in Q/A and Chat box. MD NIBAF, Mr. Riaz Chunara, thanked the Speaker for his valuable insights on the topic, LIBF host, and the audience for turning up in large number to attend the webinar. He also assured of continued cooperation between NIBAF and LIBF for such events in future.

NIBAF organized and hosted its 2nd online moot/webinar on the training challenges of the financial industry on June 15, 2021. Learning and Development as well as Human Resources departments of the financial industry were invited to the webinar. Sixty Eight L&D and HR professionals attended the event.

Topic for the webinar, this time, was Remote Learning/Training: its challenges and Way Forward. Four L&D heads from Bank Alfalah, Bank of Khyber, Albaraka Bank, and Pak-China Investment Company shared their insights on the topic.

Two expert panelists Mr. Wali Zahid, CEO Skill City, and Mr. Ijaz Nisar, President CEO Club Pakistan, discussed and responded to the points raised by industry panelists and audience.

Participants/attendees asked their questions to the panelists and expert panel through chat box and Q/A option. The industry panelists as well as expert panel highly appreciated this initiative of NIBAF by bringing all the financial industry L&D brain together and providing them an opportunity to discuss among themselves this important theme and deliberate solutions. They also emphasized a need for such events with more frequency.

Director L&D NIBAF, Syed Sajid Ali thanked all the panelists and expert panel for the very informative sessions and enlightened discussions. And presented NIBAF strategy for remote learning. He also assured all the participants that the NIBAF L&D Forum will arrange such more sessions online as well as face to face in future.

NIBAF organized an online virtual moot on the training challenges of the financial industry on January 15, 2021. Following three major challenges were identified with input from the financial industry L&D departments.

Topic 1: Learning Need Analysis, challenges faced by the industry in need assessment exercise

Topic 2: Virtual Trainings, their effectiveness, challenges, and future

Topic 3: Assessing the impact of training; issues in the application of assessment tools and methods used by the industry

Twelve (12) L&D heads from the financial industry and two experts were invited to discuss the different aspects of these challenges and suggest possible solutions. Around 70 participants attended the session virtually. The participants much appreciated NIBAF’s efforts in conducting such valuable session. They also requested NIBAF to keep arranging such sessions in future also.

NIBAF has initiated a series of webinar in collaboration with M/s Alif Technologies - a Dubai based IT Company. The target audience of this webinar series is SBP and the financial industry. The first webinar is this series was on regulation of virtual assets. The speakers for the webinar were Mr. Petri Basson, Director, IT Advisory practice, KPMG Caymen Island; Dr. Inayat Hussain, Executive Director, Banking Supervision Group, State Bank of Pakistan; Ms. Serene Liaw, Manager Research, Labuan IBFC. The next webinar in this series will be on digital onboarding.